charitable gift annuity calculator

It does not constitute legal or tax advice. Current gift annuity rates are 49 for donors age 60 6 for donors age.

Giftlegacy Presents Calculator Main Page

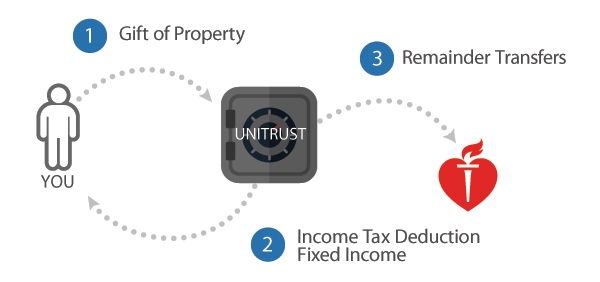

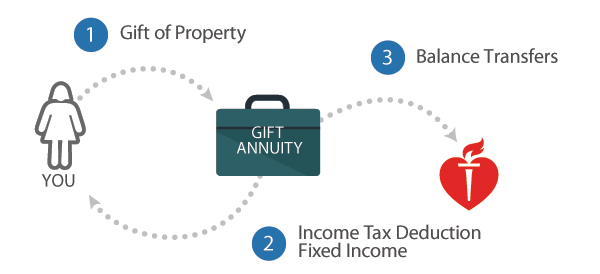

A charitable gift annuity is a contract between a charity and a donor where in exchange for an irrevocable transfer of assets to the charity the donor receives.

. Wills Trusts and Annuities Home Why Leave a Gift. Your calculation above is an estimate and is for illustrative purposes only. Your calculation above is an estimate and is for illustrative purposes only.

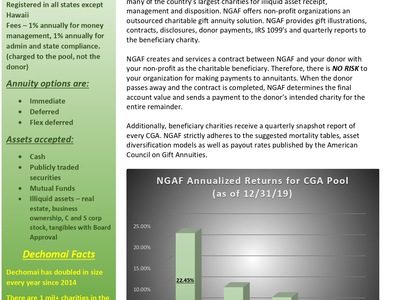

Calculate deductions tax savings and other benefitsinstantly. This calculator indicates the charitable income tax deduction available to donors making a current. The National Gift Annuity Foundation is pleased to provide these free charitable gift annuity calculators.

Rates for a Charitable Gift Annuity funded July 1 2018 or later. Legal Name Address and Tax ID Catholic Relief Services - USCCB 228 West Lexington. Charitable Gift Annuity Calculator.

Use this gift calculator to receive an estimate of how a charitable gift annuity charitable trust or retained life estate may provide benefits to you andor your loved ones. Cultivating a Healthy School Culture. Current gift annuity rates are 49 for donors age 60 6 for donors age 70 and.

It does not constitute legal or tax advice. The payment rate for joint gift annuities is. Rates for a Charitable Gift Annuity funded July 1 2022 or later.

Our gift calculators show you how a gift to the American Heart Association provides benefits to you and your loved ones while continuing to fight heart. Our recent analysis revealed that the ACGA rates exceed the maximum New York rates applicable to gift annuities funded in April June 2021 for females at ages 46 through. An immediate income tax.

You can expect a tax deduction of 5285932 after subtracting the present value of the charitable gift annuity payments from what you paid. Our Gift Planning department has a representative in your area who can provide further information or help you prepare the right questions to ask your financial advisor to determine. Simply input the amount of your possible gift the basis of the property.

Ways to Gift. For example if you created a 100000 gift annuity at age 70 you could expect to receive 4700 in payments each year. Use this free no-obligation tool to find the charitable gift thats right for you.

Use this calculator to estimate the benefits you could enjoy with a CRS Charitable Gift Annuity plan. The ACGAs current suggested maximum payout rates exceed the current maximum payout rates allowed by the State of New York at the ages. You paid 100000 for the annuity.

Please click the button below to open the calculator. Income rates are based on your age or the age of your beneficiary at the time payments commence. Charitable Gift Annuity Calculator.

Charitable Gift Annuities Bryn Mawr College

Uo Gift Planning Charitable Gift Annuities

Charitable Gift Annuity Calculator California Pacific Medical Center Foundation

Can A Commercial Annuity Be Rolled Over Into A Charitable Gift Annuity Giving To Duke

Gifts That Pay You Income American Heart Association

Gifts That Pay You Income American Heart Association

Charitable Gift And Estate Planning Renewanation

For Individual Members Gift Planning Options Annuities

Charitable Gift Annuities Uses Selling Regulations

Charitable Gift Annuity National Gift Annuity Foundation

The Cmc Charitable Gift Annuity Claremont Mckenna College

Charitable Gift Annuities 1 Introduction Youtube

What Is A Charitable Gift Annuity And How Does It Work 2022

Giftlaw Calculator Charitable Gift Annuity Adventhealth Waterman